Understanding Seller Concessions

A Guide for Homebuyers and Realtors

Navigating the path to homeownership, every bit of information plays a critical role in shaping your financial strategy and decision-making process. One key aspect that can influence the dynamics of a real estate transaction is seller concessions. This strategy can forge beneficial outcomes for both buyers and sellers, Let’s explore what seller concessions are, their benefits, and essential considerations for clients and realtors.

What Are Seller Concessions?

Seller concessions are when the seller of a home commits to covering a part of the buyer’s expenses associated with the purchase. This can include various costs such as closing fees, prepaid items, discount points, and sometimes outstanding debts. Essentially, it’s a negotiation tool that can enhance the appeal of a property to buyers or expedite the selling process.

Benefits of Seller Concessions

For Buyers

- Reduced Closing Costs: The primary advantage is lowering the amount of cash required at closing, easing the financial burden on buyers who may be stretched thin after making a down payment.

- Enhanced Buying Power: By saving on closing costs, buyers may find they can afford a home that was just beyond their budget.

- Negotiation Leverage: Being aware of seller concessions as a negotiation tactic gives buyers an additional strategy in deal negotiations, especially useful in seller-eager markets.

For Sellers

- Wider Buyer Appeal: Providing concessions can make a listing more attractive to a diverse pool of buyers, particularly those concerned about initial costs.

- Quicker Sales: Assisting with the buyer’s closing costs can lead to a faster sale, beneficial for sellers looking to move quickly.

- Strategic Negotiating Tool: In a market favoring buyers, seller concessions can be a strategic element to negotiate a better sale price by addressing some of the buyer’s expenses.

Key Considerations

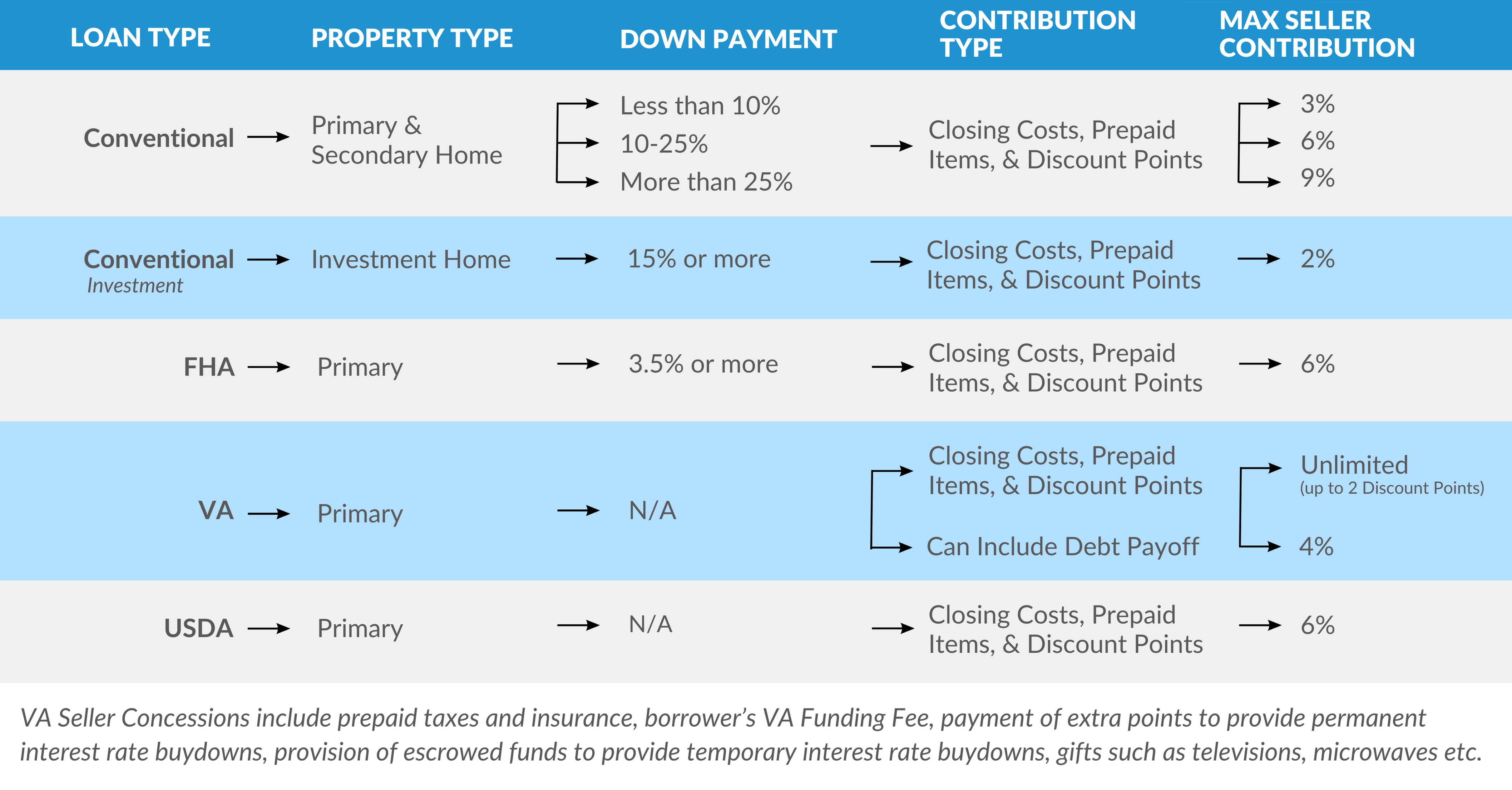

- Lender Limits: It’s crucial to remember that lenders typically cap the amount a seller can contribute to closing costs, based on a percentage of the loan amount. These limits ensure the loan-to-value ratio remains within acceptable standards.

- Market Impact: The effectiveness of seller concessions is highly influenced by current market conditions. In a competitive seller’s market, buyers may find it harder to negotiate concessions.

Seller concessions are a valuable strategy within real estate transactions, offering benefits to both buyers and sellers by enhancing the affordability and attractiveness of properties. These concessions can significantly impact the financial dynamics of buying a home, from reducing closing costs for the buyer to facilitating a quicker sale for the seller.

For a detailed overview of how seller concessions can vary by loan type, property type, down payment amount, and other critical factors, we invite you to view our Seller Contribution Matrix below. This comprehensive guide is designed to help you quickly understand the maximum seller contribution allowed for different scenarios, making it easier for buyers and sellers to plan and negotiate effectively.

If you have questions or need further clarification on how seller concessions might apply to your specific situation, our expert team at Vellum Mortgage is here to help. We are committed to providing you with personalized advice and support throughout your home buying or selling journey. Our goal is to ensure you are equipped with the knowledge and resources to make informed decisions that align with your real estate objectives.

Seller Concessions Cheat Sheet

If you have questions or need further clarification on how seller concessions might apply to your specific situation, our expert team at Vellum Mortgage is here to help. We are committed to providing you with personalized advice and support throughout your home buying or selling journey. Our goal is to ensure you are equipped with the knowledge and resources to make informed decisions that align with your real estate objectives.

Recent Posts

- Honoring Our Heroes with Homeownership

- Introducing Vellum Mortgage’s 2-Step Home Financing

- What is a Bridge Loan? Understanding Departing vs. Acquiring Residence Options

- Maximize Real Estate Investments with Vellum Mortgage’s Investor Plus Program

- Understanding Seller Concessions: A Guide for Homebuyers and Realtors